steel plate tariff code,Title: Introduction to Steel Plate Tariff Code The steel plate tariff code is an important aspect in international trade

Title: Introduction to Steel Plate Tariff Code

The steel plate tariff code is an important aspect in international trade. Tariff codes are used to classify goods for the purpose of levying customs duties. When it comes to steel plates, the specific tariff code helps determine how much tax or duty will be imposed on them when they are imported or exported. For example, in the United States, different types of steel plates may fall under different tariff codes depending on their characteristics such as thickness, quality, and intended use.

Title: Impact on Steel Plate importers

For steel plate importers, the tariff code can have a significant impact on their business. If the tariff code results in a high duty rate, it will increase their cost of importing. "How does the steel plate tariff code affect the cost of importing steel plates?" Well, a higher tariff code often means a higher percentage of the value of the goods that has to be paid as a tax at the border. This can make imported steel plates less competitive in the domestic market compared to locally produced ones. "What can importers do to deal with unfavorable steel plate tariff codes?" importers can try to negotiate with suppliers to share the cost, look for alternative sources in countries with more favorable trade agreements, or even consider lobbying for changes in the tariff code if possible.

Title: Impact on Steel Plate Exporters

Steel plate exporters also need to be aware of the tariff code. If they are exporting to a country with a complex or high - tariff code system for steel plates, it can be a barrier to their business. For instance, "How does the steel plate tariff code in the destination country influence export decisions?" The tariff code in the destination country can determine whether the exporter can make a profit or not. If the code results in a very high duty for the importer in that country, they may be less likely to buy from the exporter. "What strategies can exporters use regarding steel plate tariff codes?" Exporters can do market research to understand the tariff codes in different target markets, and they can also work with local partners in the destination country to navigate the tariff code regulations more effectively.

Title: importance of Correct Tariff Code Classification

It is crucial to classify steel plates under the correct tariff code. Incorrect classification can lead to various problems. Customs authorities rely on accurate tariff code classification to ensure fair trade. "What are the consequences of misclassifying the steel plate tariff code?" The consequences can include incorrect duty assessment, which may lead to financial losses for the importer or exporter if they end up paying too much or too little tax. It can also lead to delays in customs clearance as the authorities may need to re - assess the classification. "How can companies ensure correct steel plate tariff code classification?" Companies can hire experienced customs brokers who are knowledgeable about steel products and tariff codes, and they can also refer to official trade documentation and guidelines provided by relevant government agencies.

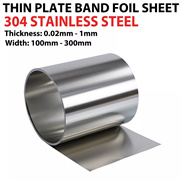

Below is,steel plate tariff codepartial price list| Category | Market Price | Use Cases |

| 16 gauge stainless sheet | 1067$/Ton | Processing equipment, conveyor belts |

| 316 stainless steel sheets | 1070$/Ton | Train cars, ships |

| 304 stainless steel cost | 1078$/Ton | pipelines, storage tanks |