steel plate tariff heading,What is Steel Plate Tariff Heading? Steel plate tariff heading is an important concept in international trade. It refers

What is Steel Plate Tariff Heading?

Steel plate tariff heading is an important concept in international trade. It refers to the specific classification code for steel plates when it comes to tariffs. Tariffs are taxes imposed on imported or exported goods, and the tariff heading helps to determine the exact rate of tax that a particular type of steel plate will be subject to.

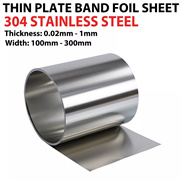

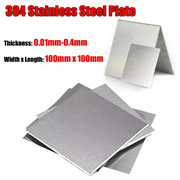

For example, in the United States, different types of steel plates may fall under different tariff headings depending on their characteristics such as thickness, composition, and end - use. A thicker steel plate used for construction might have a different tariff heading than a thinner, more specialized steel plate used in the automotive industry.

How does Steel Plate Tariff Heading Affect the Market?

The steel plate tariff heading can have a significant impact on the market. If the tariff heading results in a high tariff rate for imported steel plates, it can make imported steel more expensive. This, in turn, can give an advantage to domestic steel producers. Domestic manufacturers may see an increase in demand for their products as they become relatively more affordable compared to imports.

On the other hand, if the tariff heading leads to a lower tariff rate for certain types of imported steel plates, it can increase the competition in the domestic market. This can be beneficial for industries that rely on steel plates as they may have access to a wider variety of products at potentially lower prices.

Questions and Answers

Question 1: How can companies find the correct steel plate tariff heading?

Answer: Companies can consult official trade documents, such as the Harmonized Tariff Schedule in the United States. They can also seek help from customs brokers or trade consultants who are experienced in dealing with tariff classifications.

Question 2: What factors are considered when determining a steel plate tariff heading?

Answer: Factors such as the steel plate's thickness, its chemical composition, whether it is coated or not, and its intended use are considered when determining a steel plate tariff heading.

| Category | Market Price | Use Cases |

| 1/4 in stainless steel plate | 1037$/Ton | Processing equipment, conveyor belts |

| 1/4 stainless steel | 1092$/Ton | Surgical instruments, medical beds |

| 3/16 inch steel plate | 1101$/Ton | Automobile shells, body parts |