mild steel plate tariff code,What is Mild Steel Plate Tariff Code? Mild steel plate is a commonly used material in various industries. When it comes

What is Mild Steel Plate Tariff Code?

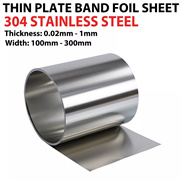

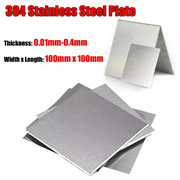

Mild steel plate is a commonly used material in various industries. When it comes to international trade, the tariff code for mild steel plate is crucial. Tariff codes are used to classify goods for the purpose of levying customs duties. The specific tariff code for mild steel plate can vary depending on factors such as the thickness, width, and finish of the plate.

In the United States, the Harmonized Tariff Schedule (HTS) is used to classify goods. For mild steel plate, it may fall under a specific code within the HTS. This code helps customs officials determine the appropriate tax or duty to be imposed on the import or export of mild steel plates.

Businesses that deal with mild steel plates need to be aware of the correct tariff code to ensure compliance with trade regulations. Incorrectly classifying the product can lead to issues such as over - or under - payment of duties, which can result in financial losses or legal problems.

Moreover, understanding the tariff code can also help in comparing prices across different suppliers. If a supplier quotes a price that seems too good to be true, it could be because they are misclassifying the mild steel plate under a different (and potentially incorrect) tariff code.

Questions and Answers about Mild Steel Plate Tariff Code

Question: How can I find the accurate mild steel plate tariff code?Answer: You can refer to the Harmonized Tariff Schedule (HTS) in the United States. Also, you can consult with customs brokers or trade experts who are familiar with the classification of steel products. They can help you determine the correct code based on the characteristics of your mild steel plate, such as its thickness, width, and finish.

Question: What are the consequences of using the wrong mild steel plate tariff code?Answer: If you use the wrong tariff code for mild steel plate, it can lead to incorrect payment of duties. You may end up paying too much or too little. Paying too little can result in penalties and legal issues as it is considered evasion of customs duties. Paying too much means unnecessary financial losses for your business. Additionally, it can cause delays in the customs clearance process as the authorities may need to re - classify the product.

Below is,mild steel plate tariff codepartial price list| Category | Market Price | Use Cases |

| 8 x 4 stainless steel sheet | 1054$/Ton | Surgical instruments, medical beds |

| 1/8 stainless steel sheet | 1056$/Ton | Handrails, doors and windows |

| 1 4 inch stainless steel rod | 1062$/Ton | Stair handrails, walls |

| 17 4 stainless steel plate | 1076$/Ton | Handrails, doors and windows |

| 4 8 stainless steel sheets | 1107$/Ton | Storage, transportation |